Poland records EU’s highest increase in house prices

Poland recorded the EU’s largest increase in house prices in the final quarter of 2023. Costs were up 13% on a year earlier and 4.8% on the previous quarter, new Eurostat data show. Across the EU as a whole, prices remained broadly flat.

The rises seen in Poland continued to be driven by a popular mortgage subsidy scheme for first-time buyers introduced by the previous government last year and which was available until the end of 2023.

Although some data indicate that growth slowed at the beginning of the year, in recent weeks prices have started rising again after the new government, which came to power in December, announced its own version of the mortgage subsidy programme earlier this month.

Poland’s annual house price growth of 13% in the fourth quarter of 2023 was ahead of Bulgaria (10.1%) and Croatia (9.5%), which saw the second and third largest rises respectively.

At the other end of the scale, Luxembourg (-14.4%), Germany (7.1%) and Finland (-4.4%) saw the largest falls in prices. Across the EU as a whole, prices were up 0.2%.

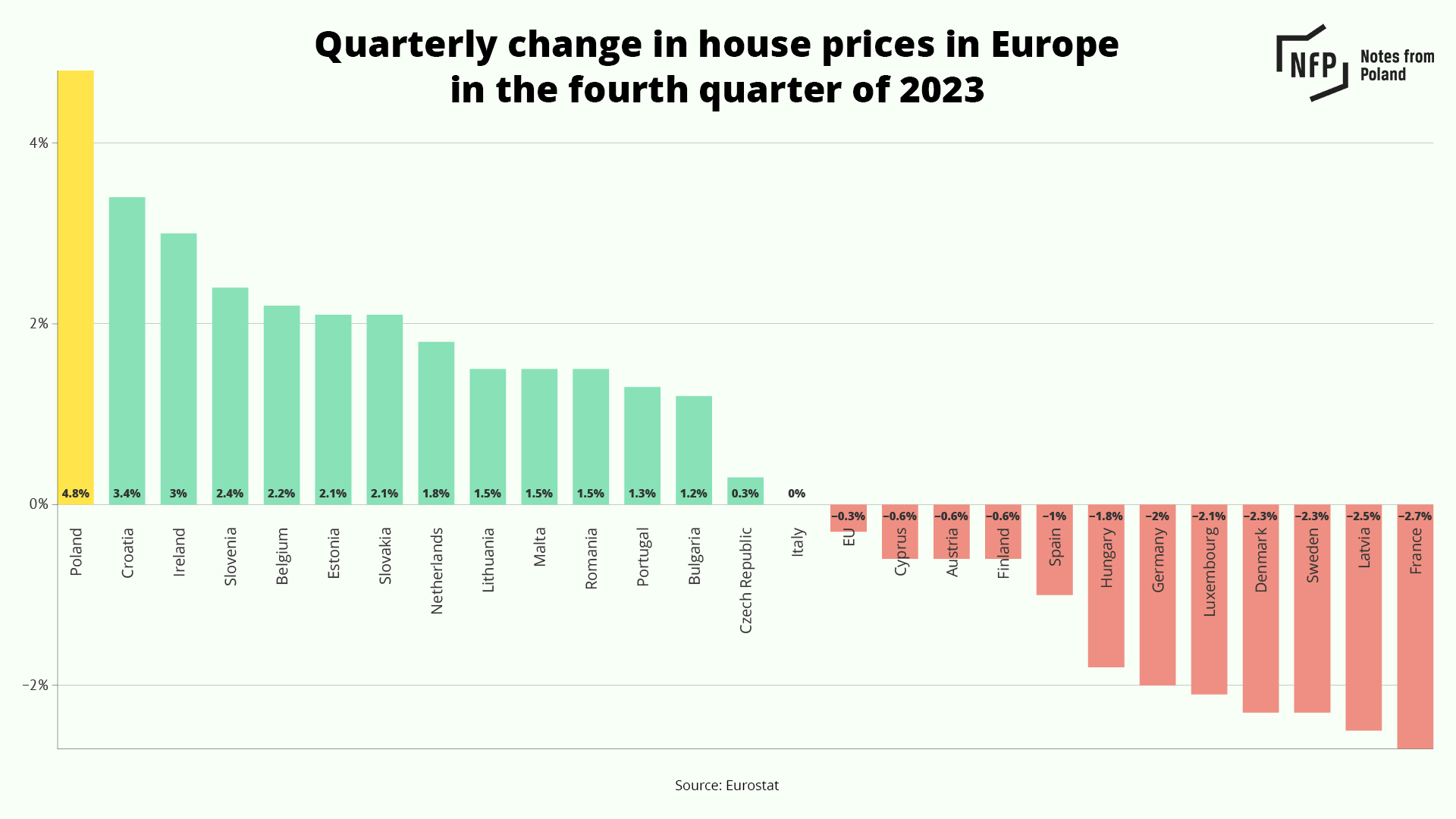

On a quarterly basis, Poland’s 4.8% increase was also the largest in the bloc, followed by Croatia (3.4%) and Ireland (3%).

Across the EU as a whole, prices fell 0.3% between the third and fourth quarters, with the largest drops in France (-2.7%), Latvia (-2.5%) and Sweden (-2.3%).

Poland had already seen the bloc’s second-fastest housing price increase in the third quarter of 2023, at 9.3% year-on-year, when the mortgage subsidy programme introduced by the then Law and Justice (PiS) government was first implemented.

The scheme saw mortgage applications record a three-fold year-on-year increase in July. There was also a record number of applications in December as the scheme came to an end.

In January, meanwhile, mortgage lending exceeded 10 billion zloty (€2.3 billion) for the first time in history as the contracts eligible for the programme were finalised.

In January, the value of mortgages issued in Poland exceeded 10bn zloty (€2.3bn) for the first time – and was five times larger than a year earlier – as the last loans eligible for a state subsidy scheme for first-time buyers were finalised https://t.co/kLYYxGgHwa

— Notes from Poland 🇵🇱 (@notesfrompoland) February 28, 2024

Prices have also been pushed up by a shortage of housing, with some estimates pointing to a shortfall of as many as 4 million units. That has made entering the market difficult for young Poles, nearly half of whom live with their parents, one of the highest figures in the EU.

As the impact of the programme faded in the first quarter of 2024, prices in some Polish cities started to fall slightly, according to price aggregation website Zametr. However, they began to rise again when the current government presented plans on 8 April for its own version of the subsidies programme.

In the week preceding the unveiling of the planned new scheme for first-time buyers, nearly 80% of prices reported by the website on the primary market in Warsaw recorded declines. In the week after, more than 90% of listings had their prices increased.

Bezpieczniki w projekcie przepalone w starciu z psychologią. Podobnie jak w przypadku BK2%, sama zapowiedź nowego projektu kredytowego wpływa na ceny ofertowe. pic.twitter.com/o4Y4tJE9Wn

— zametr.pl (@zametr) April 16, 2024

The planned new scheme will guarantee that mortgage interest rates for first-time buyers will be no higher than 1.5%. The interest rate may be lower if the household includes children. For a family with at least three children, the interest rate will be set at 0%.

In the previous edition of the programme, the guaranteed interest rate for all participants was 2%. In the new edition, as in the previous one, the state pays the difference between the market interest rate and the rate guaranteed by the programme.

The new scheme will be available to people up to 35 years of age if single, but there will be no age limit for married couples. In the previous edition, the scheme was open to people up to 40 years of age

The amount of the housing loan will not be capped, but the subsidy will only be available for part of the loan, from 200,000 zloty (€46,220) for a single-person household up to 600,000 zloty (€138,670) for a household consisting of at least five people.

Poles purchased almost 3,000 residential properties in Spain last year, a record figure and annual rise of 160%.

We visited the Costa Blanca to look at what is behind this trend and how the growing Polish presence is being felt https://t.co/FBoqmvyHe8

— Notes from Poland 🇵🇱 (@notesfrompoland) June 6, 2023

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Krzysztof Kowalik / Unsplash

Alicja Ptak is senior editor at Notes from Poland and a multimedia journalist. She previously worked for Reuters.