Poland sees EU’s highest annual housing price rise of 18%

Housing prices in Poland were 18% higher than a year earlier in the first quarter of 2024, which was the largest figure in the European Union for the second successive quarter, new Eurostat figures show.

Poland was followed by Bulgaria and Lithuania, which saw increases of 16% and 9.9% respectively. At the other end of the scale, Luxembourg (-10.9%), Germany (-5.7%) and France (-4.8%) saw the largest falls in prices. Across the EU as a whole, prices were up 1.3%.

Poland’s latest figure marks an acceleration from the final quarter of 2023, when it saw an annual rise of 13%, which was also the highest figure in the EU. In the third quarter of 2023, its rise of 9.3% was the second-highest in the bloc.

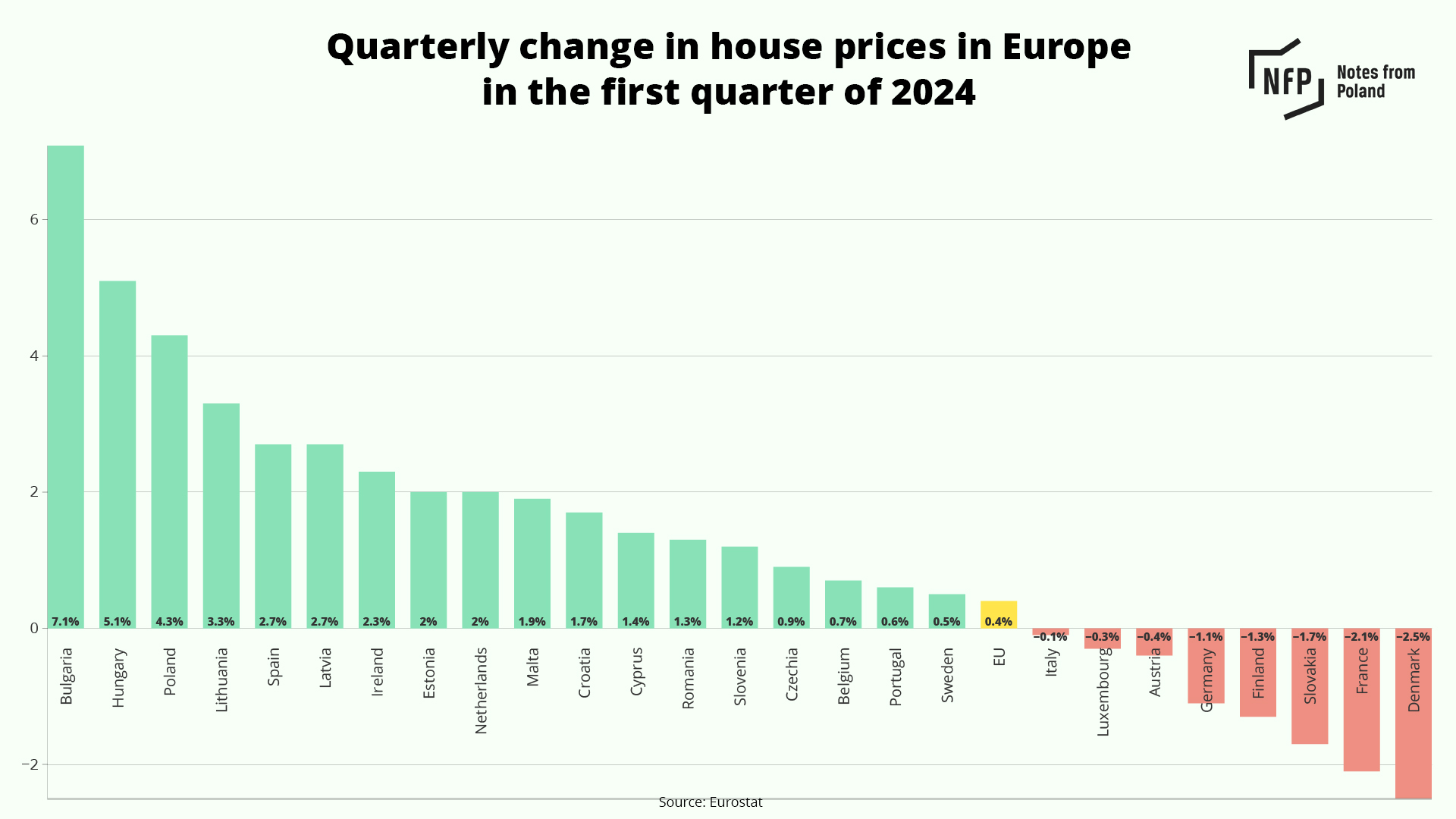

In the first quarter of this year, housing prices in Poland were up 4.3% compared to the previous quarter, which was the third-highest rate in the EU, behind Bulgaria (7.1%) and Hungary (5.1%).

Across the EU as a whole, prices rose 0.4% between the fourth quarter of 2023 and first quarter 2024, with the largest drops in Denmark (-2.5%), France (-2.1%) and Slovakia (-1.7%).

Housing price growth in Poland was last year bolstered by the popular “Safe Credit” mortgage subsidy programme for first-time buyers introduced under the previous Law and Justice (PiS) government in July.

As the scheme was nearing its end in late 2023, Poland saw a record number of mortgage applications in December, while in January mortgage lending exceeded 10 billion zloty (€2.3 billion) for the first time in history as the contracts eligible for the programme were finalised.

Prices have also been pushed up by a housing shortage in Poland, with some estimates pointing to a shortfall of as many as 4 million units. That has made entering the market difficult for young Poles, over half of whom, according to Eurostat, live with their parents, one of the highest figures in the EU.

A large influx of refugees from Ukraine following Russia’s invasion in 2022 has also put pressure on Poland’s housing market.

Sorry to interrupt your reading. The article continues below.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

After the subsidy scheme ended, new Prime Minister Donald Tusk, who took office in December, announced that it would be relaunched in modified form under his government. The development ministry has plans for that to happen early next year.

There is, however, no agreement on exactly what form it should take within Tusk’s broad ruling coalition, which includes his centrist Civic Coalition (KO), the centre-right Polish People’s Party (PSL), centrist Poland 2050 (Polska 2050), and The Left (Lewica).

The latter of those groups, in particular, has strongly opposed another mortgage subsidy scheme, arguing it will lead to further increases in housing prices. The Left instead advocates for the state to increase the supply of low-cost rental housing.

Kredyt 0%? Nie z nami. ⤵️ https://t.co/nB9p4Brakc

— Lewica (@__Lewica) May 30, 2024

Szymon Hołownia, the leader of Poland 2050 and speaker of parliament, has also spoken in favour of supporting social housing.

“No more programmes like ‘Safe Credit’, which has enriched developers in metropolitan areas and led to price increases across the country,” said Hołownia, quoted by the Rzeczpospolita daily.

However, development minister Krzysztof Paszyk, who hails from PSL, said this week that he has been holding talks with their coalition partners and is confident an agreement on a new mortgage subsidy scheme can be reached. He said that a bill could be introduced to parliament after the summer holidays.

Kredyt 0 proc. jednak się pojawi? Minister zabrał głos https://t.co/GiAOsIvLmb

— Business Insider Polska 🇵🇱 (@BIPolska) July 5, 2024

Main image credit: Wiktor Karkocha/Unsplash

Alicja Ptak is senior editor at Notes from Poland and a multimedia journalist. She previously worked for Reuters.