Poland’s booming battery industry threatened by proposed EU emission rules

By Alicja Ptak

Poland is Europe’s leading producer of lithium-ion batteries and second globally, behind only China. But the future of the industry is now in question as the EU considers tougher emissions rules that could hit Poland’s coal-dependent economy in particular.

In February this year, the Battery Regulation, an EU law regulating the production and waste management of batteries, came into force. It will be accompanied by a series of delegated acts that will set out detailed rules for the functioning of the battery market in the bloc.

These acts are still being negotiated in Brussels but there are concerns that they could bring about the end of Poland’s dominance in the battery sector, which is set to play a key role in electrification and the energy transition. Other member states also want to have a bite of what, according to consultancy firm McKinsey, will be a $400 billion pie by 2030.

Poland last year overtook the US to have the world’s second-largest production capacity for lithium-ion batteries, behind only China.

The batteries now account for 2.4% of all Poland’s exports https://t.co/dpWZBGlpx5

— Notes from Poland 🇵🇱 (@notesfrompoland) April 6, 2023

One of the delegated acts will set out rules for calculating batteries’ carbon footprint, the results of which could impact not only subsidies but also investors’ decisions about where to locate their plants.

In recent years, companies have been keen to set up manufacturing facilities in Poland due to its proximity to the German market and its educated but relatively cheap labour force.

Today the country is home to Europe’s biggest battery manufacturing facility – the LG Energy Solution plant in Wrocław – which, according to the International Energy Agency (IEA), accounts for half of the total battery manufacturing capacity in Europe.

Europe’s largest factory for energy storage systems is to be built in Poland.

Swedish firm @northvolt says the $200 million facility, which includes an R&D centre, will provide technical solutions “for ending industrial dependence on fossil fuels” https://t.co/spYHVNZAxN

— Notes from Poland 🇵🇱 (@notesfrompoland) February 22, 2021

At present, when a manufacturer wants to lower its carbon footprint to make its batteries more attractive to green-minded customers, it can use so-called power purchase agreements (PPAs) to buy green energy directly from a supplier or offset emissions by purchasing clean energy certificates to subsidise the carbon debt.

However, during the consultation process on the methodology for calculating batteries’ carbon footprint, which finished at the end of May 2024, a number of countries advocated for the European Commission to abandon the possibility of offsetting emissions, reports the Polish Economic Institute (PIE).

Instead, they proposed that the carbon footprint should be calculated based on the emission intensity of the electricity production in the country where the battery factory is located.

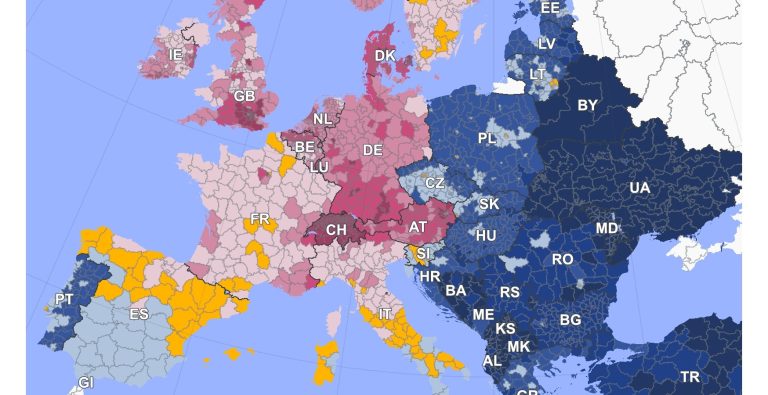

This would benefit countries with a high share of renewables and nuclear power, like France, Sweden and Finland, but it would be a blow to countries such as Poland, which, despite increasing efforts to go green, still lags well behind.

Last year, 63.8% of Poland’s power production came from coal, by far the highest proportion in the EU. In 2022, Poland was ranked as the EU’s least green country.

Renewables generated a record 26% of Poland’s electricity in 2023, up from 19% the previous year.

However, coal continued to produce most of the country’s power, accounting for almost two thirds of the energy mix https://t.co/JQqfMkOK4I

— Notes from Poland 🇵🇱 (@notesfrompoland) January 3, 2024

Such a change in the rules would also hit Germany, which has moved away from nuclear energy in recent years. At the end of July, five large German business associations spoke out against the proposed new methodology, according to news magazine Focus.

“It is understandable that current and emerging manufacturing leaders may have reservations [about the proposal],” Kamil Lipiński, head of the energy and climate department at PIE, told Notes from Poland.

He pointed to the huge differences in the emissions intensity of the countries in question: “On some days…it is 750g/kWh in Poland, 454g/kWh in Germany, and 21g/kWh in France.”

According to PIE’s calculations, the carbon footprint of one kWh of battery produced in France is around 3-4 kilograms, while in Poland it is over ten times higher, at around 40 kilograms.

Sorry to interrupt your reading. The article continues below.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

What does Poland – and the EU – stand to lose?

Aleksander Rajch, a board member of the New Mobility Association (PSNM), which supports the development of electromobility and alternative fuels in Poland and Central and Eastern Europe, claims that the proposed changes could potentially hit the battery industry not only in Poland, but also in the wider EU.

“The change, if passed, will be negative because it really diminishes the potential of the industry in this region. And it doesn’t mean that it will go to Western Europe alone. It will also shift away to North America or Asia,” he told Notes from Poland.

For Poland, meanwhile, adopting the proposed methodology would mean the loss of future investments in one of its key export sectors. In the first quarter of this year alone, battery exports amounted to 12 billion zloty (€2.81 billion), around 2% of Poland’s total goods exports, second only to automotive parts in terms of value.

“That is, of course, bad for Poland’s economy. It is bad for the labour market,” said Rajch. “We have the potential in Central and Eastern Europe to become a competitive hub of battery production. If we take this potential away because of other problems [slow transition to green energy], then we’re making the wrong move here.”

Google, Amazon, Mercedes and Ikea have appealed to Poland’s prime minister and parliament to support the development of green energy.

Otherwise, „the Polish economy is in danger of losing its competitiveness and attractiveness”, they warn https://t.co/ytVcdwwiT1

— Notes from Poland 🇵🇱 (@notesfrompoland) February 21, 2023

Mario Draghi, the former governor of the European Central Bank (ECB), also warned against the loss of key sectors for the future of decarbonisation in his recent report on the future of European competitiveness prepared for the European Commission (EC).

“Chinese competition is becoming acute, driven by a powerful combination of subsidies, innovation and scale,” Draghi said when presenting the report in the European Parliament. “There are still other sectors, like batteries, where we do not want to be fully dependent on foreign technology for strategic reasons, and so it is key to keep the know-how in Europe.”

According to Fabrice Stassi, secretary general at Batteries European Partnership Association (BEPA), linking carbon footprint to a country’s energy mix also does not make sense “from a risk management point of view”.

“We should not penalise countries for their energy mix, considering that not all countries have improved their grids at the same time,” he said during PSNM’s New Mobility Congress in Łódź in September. “We should try to find a solution that works for all, because otherwise you will end up putting battery investments in only a few countries.”

An uncertain future for Polish battery production

Piotr Jarmowicz, an expert on EU industrial policy and regulations at the Polish development ministry, believes that the change proposed to the EC would be “devastating for countries such as Poland”.

“The European Commission has to be reminded all the time that no region should be left behind,” he said during the New Mobility Congress. “What we should all expect from the EU regulatory framework is some fairness, basic fairness.”

Polish businesses, meanwhile, are hoping that the EC to allow them to calculate carbon footprint on a “case by case basis”.

“If one investor is able to invest, for instance, in wind [energy], in solar fields, then why should they be penalised because they are in a country with a mix that puts them at disadvantage?” Andrzej Kublik, the CEO of QSense, a quality control, battery life cycle management company, told Notes from Poland.

Poland’s climate ministry has outlined plans for the country to generate three quarters of its electricity from zero-emissions sources by 2040, with 51% coming from renewables and almost 23% from nuclear https://t.co/CksVqGQXkV

— Notes from Poland 🇵🇱 (@notesfrompoland) April 4, 2023

It is not clear when the European Commission will present its final draft to the European Parliament and the European Council for approval. In response to a query from Notes from Poland, the commission only said that work on the delegated act “is still ongoing”.

“The commission held an expert group meeting on 11 July, where member states were given the opportunity to raise further comments concerning the draft delegated act in writing,” it said. “The commission is currently consolidating all the feedback received by the member states and analysing the possible way forward.”

According to environmental lawyer Radosław Maruszkin, even if the act was adopted, Poland as a member state could complain to the Court of Justice of the European Union about the invalidity of such a delegated act. However, such appeals are “rarely successful,” he added at the New Mobility Congress.

Such a process, even if it were eventually successful, would also be time-consuming and would create further uncertainty – something that in itself may discourage further investment and development in one of Poland’s most important industries.

Main image credit: Northvolt AB

Alicja Ptak is senior editor at Notes from Poland and a multimedia journalist. She previously worked for Reuters.